Individual yet intertwined, We the People have the right and responsibility for vivid awareness, vigorous debate and vigilant oversight.

Thursday, January 3, 2013

Raise the state's estate tax exemption to federal level

The New Jersey Estate Tax raises an estimated $675 million, or about 2.5% of the total budget revenues based on taxing all estate value over about $650,000. Yet, the U.S. federal government exempts the first $5 million.

New Jersey has 2 of the top 10 wealthiest counties in the nation. And New Jersey is a relatively high cost-of-living state. So people's homes tend to inflate their net worth and there are plenty of people with net worth over $5 million.

So I suggest that such a low estate tax exemption of $5 million sounds more appropriate than the current $675,000 NJ tax exemption level.

Talk about sticking it to the little guy ... the New Jersey Estate Tax bits hardest on the first bite: The first $52,000 above the $675,000 exemption is taxed at 37%. The first $52,000 of your estate will be taxed at 37% !!!! ... That's right thirty-seven percent at the bottom of the estate size!!! Then it drops down to 4% !!! ... That's right four percent!!! ... and rises slowly from there.

If national statistics hold in New Jersey, then half, or more, of the total net worth of NJ residents are those estates worth more than $5 million. So raising our NJ estate tax exemption level from $650,000 to $5 million likely will cost the state an estimated $350 million or just over 1% in tax revenue. That's would be a small concession by the state in return for a lot of financial security for the average Jerseyan ... small businessperson, family.

Raise the NJ estate tax exemption to the first $5 million.

By Steven J. Reichenstein

U.S. Tax Reform: Focus on Simplification & Streamlining

National discussion on how to change our U.S. income tax rates, and every other tax rates, requires national understanding of all of the exceptions and exemptions. We will be at the mercy of elected officials and media for the details, and those matter so much to the reality as opposed to the appearance of tax structure.

Therefore, I propose we simplify and streamline all federal revenue and expenditure categorizations in the budget, and we keep all categories in the budget as opposed to the now many "off-budget" items.

If we have fewer categories and easy-to-understand categories, then we can more easily see and adjust the revenue and expenditure formulas in ways that all of us can readily understand and subject to comment.

I propose simplifying our federal tax structure by reducing the number of tax types and tax rate exceptions, at first, to zero.

Let's start from scratch on the revenue side with just the now enacted tax agreement of January 1, 2013.

Let's rebuild the tangled chart of taxes, exceptions, and fees together in real time national discussions over the next few weeks. Together, let's build a simple, streamlined tax structure that clearly communicates to everyone.

We have catchall revenue categories like personal income tax, business income tax, excise tax, and service & permit fees. Then we have national insurances of Medicare, Social Security, Medicaid, and flood & natural disaster. And finally, we have fiscal policy revenues that are intended to tap specific activities for specific reasons.

Within personal income tax structure, we have salary income, bonus income, rental income, sale of assets income, dividends, interest, inheritance, gift, and prize-lottery-gambling incomes. Each of these types or sources of income are taxed differently -- different basis, different rates, and different exemptions. Let's simplify this.

Let's establish maxims, or guidelines, to use in categorizing revenues. For example:

- Let's separate benefit income and earned income. Inheritance, gift, prize, and lottery income are given between people in our personal lives.

--- Salary, bonus, rental, asset sales, dividends, and interest income are all derived through our business interactions.

--- Social insurances revenues are premium payments targeted from and to specific policy accounts we all have for old-age health, old-age pension, disability health & pension, and flood & natural disaster relief.

Let's establish maxims for expenditure, as well. For example:

- Separate consumption vs. investment vs. social insurance expenditures, for example:

--- Defense, State, Justice, CIA, Capitol Police, Secret Service, Treasury, Census, and Homeland Security departments are clearly consumption expenditures.

--- Commerce, Education, Interior, Housing & Urban Development, Health & Human Services, and Energy departments spend on programs that are directly investment expenditures.

--- Social Security, Medicare, Medicaid, and flood & natural disaster relief would be considered social insurance expenditures.

--- Expenditures form the General Services Administration, for example, should be allocated to the departments & agencies which benefit directly from each service expenditure (e.g. computers, pencils & pens according to who ordered them and real estate property according to who occupies them).

Let's adopt at least the first three of the often-cited 'invisible hand' 18th century Scottish economist Adam Smith's "Maxims for Taxation" in his famous book "Wealth of Nations":

- First, base amount of payment on ability to pay

- Second, make payment(s) due at times reasonably convenient for people and businesses, with consideration to such influences like the seasonal cycle and online.

- Third, make the payment process cost the least possible amount to both collector and payer.

Let's decide first and foremost what should and shouldn't our federal government do for us, as in what we do as a nation rather than independently, and this should be based on both the Constitution (e.g. Census) and the popular preferences (provided they are not directly prohibited by the Constitution).

Now, please note that I approached this topic in the reverse order from which the decisions likely should be made, but that's because the issue is discussed publicly as "tax reform" rather than government operations.

In reality, I recommend starting with what we must and want our government to do; then setting overarching guidelines; then dividing into categories; and, finally, how much it costs for us as a nation to do these and how we as a nation will pay for it.

By Steven J Reichenstein

Therefore, I propose we simplify and streamline all federal revenue and expenditure categorizations in the budget, and we keep all categories in the budget as opposed to the now many "off-budget" items.

If we have fewer categories and easy-to-understand categories, then we can more easily see and adjust the revenue and expenditure formulas in ways that all of us can readily understand and subject to comment.

I propose simplifying our federal tax structure by reducing the number of tax types and tax rate exceptions, at first, to zero.

Let's start from scratch on the revenue side with just the now enacted tax agreement of January 1, 2013.

Let's rebuild the tangled chart of taxes, exceptions, and fees together in real time national discussions over the next few weeks. Together, let's build a simple, streamlined tax structure that clearly communicates to everyone.

We have catchall revenue categories like personal income tax, business income tax, excise tax, and service & permit fees. Then we have national insurances of Medicare, Social Security, Medicaid, and flood & natural disaster. And finally, we have fiscal policy revenues that are intended to tap specific activities for specific reasons.

Within personal income tax structure, we have salary income, bonus income, rental income, sale of assets income, dividends, interest, inheritance, gift, and prize-lottery-gambling incomes. Each of these types or sources of income are taxed differently -- different basis, different rates, and different exemptions. Let's simplify this.

Let's establish maxims, or guidelines, to use in categorizing revenues. For example:

- Let's separate benefit income and earned income. Inheritance, gift, prize, and lottery income are given between people in our personal lives.

--- Salary, bonus, rental, asset sales, dividends, and interest income are all derived through our business interactions.

--- Social insurances revenues are premium payments targeted from and to specific policy accounts we all have for old-age health, old-age pension, disability health & pension, and flood & natural disaster relief.

Let's establish maxims for expenditure, as well. For example:

- Separate consumption vs. investment vs. social insurance expenditures, for example:

--- Defense, State, Justice, CIA, Capitol Police, Secret Service, Treasury, Census, and Homeland Security departments are clearly consumption expenditures.

--- Commerce, Education, Interior, Housing & Urban Development, Health & Human Services, and Energy departments spend on programs that are directly investment expenditures.

--- Social Security, Medicare, Medicaid, and flood & natural disaster relief would be considered social insurance expenditures.

--- Expenditures form the General Services Administration, for example, should be allocated to the departments & agencies which benefit directly from each service expenditure (e.g. computers, pencils & pens according to who ordered them and real estate property according to who occupies them).

Let's adopt at least the first three of the often-cited 'invisible hand' 18th century Scottish economist Adam Smith's "Maxims for Taxation" in his famous book "Wealth of Nations":

- First, base amount of payment on ability to pay

- Second, make payment(s) due at times reasonably convenient for people and businesses, with consideration to such influences like the seasonal cycle and online.

- Third, make the payment process cost the least possible amount to both collector and payer.

Let's decide first and foremost what should and shouldn't our federal government do for us, as in what we do as a nation rather than independently, and this should be based on both the Constitution (e.g. Census) and the popular preferences (provided they are not directly prohibited by the Constitution).

Now, please note that I approached this topic in the reverse order from which the decisions likely should be made, but that's because the issue is discussed publicly as "tax reform" rather than government operations.

In reality, I recommend starting with what we must and want our government to do; then setting overarching guidelines; then dividing into categories; and, finally, how much it costs for us as a nation to do these and how we as a nation will pay for it.

By Steven J Reichenstein

Wednesday, January 2, 2013

Universal Service Charge: A 16.1% tax on your phone bill, double excise taxation

Look at your land line, wireless phone, and cable bills.

Do you see the "Universal Service Charge" under "government surcharges & fees". You should pay attention. This is a steep tax.

This tax is has been 17.4% of your monthly bill until 1st quarter 2013 when it dropped to 16.1%.

The "Universal Service Charge" is a tax imposed in addition to the rather comprehensive bundle of the usual taxes: Federal excise tax, federal FCC regulatory fee, and state & local taxes. So I wondered what is a Universal Service Charge ... also called the Universal Connectivity Charge.

This falls under the Federal Communications Commission (FCC) one of the so-called 'independent regulatory commissions' reporting to both President and Congress, like the Securities and Exchange Commission (SEC) and Food & Drug Commission (FDA).

I looked it up, and here's what I found:

In breaking up Bell Telephone (into the "Baby Bells" and "AT&T") and later, in the 1996 Telecommunications Act, allowing competition in local as well as long-distance services, the Congress ended the Bell Telephone Company monopoly ... and the requirement to provide phone service to every home in America. And that created a political problem:

Without the guarantee of cost-plus rates in a monopoly, phone companies, including those which comprised the original Bell, would not ensure phone service in areas where the cost-rate equation wasn't profitable: Rural, low-income, etc.

So Congress formed a Federal-State Joint Board to figure out a way to ensure telecommunications service to these otherwise unprofitable areas. The Board decided upon a list of telecommunications services that everyone had the "right" to have at "reasonable costs".

In 1997, Congress acted on the Board's report by creating the "Universal Services Fund" to subsidize services to 4 new programs: High Cost, Low Income, Rural Health Care, and Schools & Libraries.

The Universal Services Fund is overseen by the Federal Communications Commission (FCC) through the "Universal Services Administrative Company" an independent not-for-profit corporation set up to record the Universal Services Fees collected into "The Fund" and the disbursements from "The Fund" to the 4 programs.

The actual collection of the money be done by each state's "Public Utilities Commission" ... based on something called the "public interest standard". The regulations also call for "appropriate communications carriers" to actually provide the 4 programs' service at these Universal Service Fund" subsidized rates. It's based on a percentage of your phone service per line/phone and paid by carriers to the Universal Service Administrative Company quarterly.

Well, a per item tax collected by an indirect source, such as a merchant ... or phone company ... is the actual definition of an excise tax. So the Universal Service Charge is a rose by another name. The federal government charges 2 excise taxes on phones!!

Assuming that everyone is charged $3 per phone per month for the USF, the U.S. has more than 100-million households plus millions of businesses; and each household and business often have more than one phone (multiple mobile phones or 1 mobile and 1 land) the Universal Service Fund (USF) collects more than $300 million per month or more than $3.6 billion annually (probably $5+ billion).

That's a lot of money!! And, it's just 1 of the 2 excise taxes charged on phones!!

Personally, I object to the Universal Service Charge (or Universal Connectivity Charge) and the whole tangle of entities built around it. This should be consolidated into one of the federal cabinet departments. This should be an on-budget item.

Furthermore, this is excessive excise taxing and it shouldn't be an off-budget tax. Why should I be assessed for me to subsidize rural residents' phone service ... or anyone's phone service?

How ironic that Congress does not see healthcare as a human right but they do see telephones as a human right.

Whether or not you believe in the Universal Service Fund mission, you can agree that the tangle of off-budget entities is a wasteful bureaucracy that should be consolidated into a cabinet department and a hidden tax that should be discussed and handled openly.

Please, sign a petition, contact a Congressman, write a letter to the editor, or discuss this with your friends and family. That's the only way we can put this on the national agenda to take it off of the national tax rolls.

By Steven J. Reichenstein

Labels:

excise tax,

phone bill,

universal service administrative company,

universal service charge,

universal service fund

Tuesday, January 1, 2013

Senator William Proxmire and the "Golden Fleece Award"

Each year from 1975 to 1987, Senator William Proxmire (D-WI) issued a "Golden Fleece" Award "to the biggest, most ridiculous or most ironic example of (U.S.) government spending or waste".

Although Senator William Proxmire (1915-2005) retired in 1987, his focus on specific examples of what he considered unnecessary spending could bring the public into the debates in a meaningful way because the debates over spending could be about specific spending items.

President Reagan also sought to specify the debate when he initiated a campaign for a "Line Item Veto". President Clinton finally got a line item veto law passed in 1996 and became the first U.S. President to use it. President Obama has renewed the line item veto campaign by requesting an "updated' or enhanced line item veto.

I believe that when the debates are about vague references to "wasteful" and "inappropriate" spending by governments or catchall groupings, like "entitlements", then the debates can only coalesce around "Conservative", "Progressive", "Liberal", "Republican", "Democrat", etc.

The first Golden Fleece Award, in 1975, was to President Ford's administration, to the National Science Foundation, for spending $84,000 (est. $240,000 in 2007 dollars) to study why people fall in love.

Senator Proxmire issued the Golden Fleece Award almost monthly and, importantly, issued to both Republicans and Democrats.

For example, in September 1979, the Senator issued an award to the National Science Foundation for spending $39,600 (est. $45,000 in 2007 dollars) to study "Himalayan mountaineering, social change, and the evolution of the (Buddhist) religion among the Sherpa of Nepal".

In his final year in the Senate, Proxmire issued a Golden Fleece Award to President Reagan's administration, to the Air Force, for spending $59,000 (est. $100,000 in 2007 dollars) over 6 years on playing cards given as souvenirs on Air Force Two (then Vice-President George Herbert Walker Bush's airplane).

I do not agree with all of Senator Proxmire's Golden Fleece Award selections. (In fact, several have born out to be quite valuable over the past 40 years.) But I agree with the fact of identifying specific line items.

In it's time, the Golden Fleece Award was very well publicized and popular. So, I believe, that reviving a debate about the specifics rather than the catchall would be well-received now.

Of course, all members of House and Senate should get involved and, perhaps, pick their own Golden Fleece items. And, we also should post online, sufficiently before budget votes, in clearly understood colloquial terms, all of the spending items. Real transparency: Isn't that democracy?

By Steven J. Reichenstein

Although Senator William Proxmire (1915-2005) retired in 1987, his focus on specific examples of what he considered unnecessary spending could bring the public into the debates in a meaningful way because the debates over spending could be about specific spending items.

President Reagan also sought to specify the debate when he initiated a campaign for a "Line Item Veto". President Clinton finally got a line item veto law passed in 1996 and became the first U.S. President to use it. President Obama has renewed the line item veto campaign by requesting an "updated' or enhanced line item veto.

I believe that when the debates are about vague references to "wasteful" and "inappropriate" spending by governments or catchall groupings, like "entitlements", then the debates can only coalesce around "Conservative", "Progressive", "Liberal", "Republican", "Democrat", etc.

The first Golden Fleece Award, in 1975, was to President Ford's administration, to the National Science Foundation, for spending $84,000 (est. $240,000 in 2007 dollars) to study why people fall in love.

Senator Proxmire issued the Golden Fleece Award almost monthly and, importantly, issued to both Republicans and Democrats.

For example, in September 1979, the Senator issued an award to the National Science Foundation for spending $39,600 (est. $45,000 in 2007 dollars) to study "Himalayan mountaineering, social change, and the evolution of the (Buddhist) religion among the Sherpa of Nepal".

In his final year in the Senate, Proxmire issued a Golden Fleece Award to President Reagan's administration, to the Air Force, for spending $59,000 (est. $100,000 in 2007 dollars) over 6 years on playing cards given as souvenirs on Air Force Two (then Vice-President George Herbert Walker Bush's airplane).

I do not agree with all of Senator Proxmire's Golden Fleece Award selections. (In fact, several have born out to be quite valuable over the past 40 years.) But I agree with the fact of identifying specific line items.

In it's time, the Golden Fleece Award was very well publicized and popular. So, I believe, that reviving a debate about the specifics rather than the catchall would be well-received now.

Of course, all members of House and Senate should get involved and, perhaps, pick their own Golden Fleece items. And, we also should post online, sufficiently before budget votes, in clearly understood colloquial terms, all of the spending items. Real transparency: Isn't that democracy?

By Steven J. Reichenstein

Saturday, December 29, 2012

Workers' Compensation Insurance vs. Group Health Insurance: The Employer's Dilemma is which to file

An employee suddenly develops a back problem, a serious one like a herniated disc. It does not occur from an accident that anyone noticed but his/her employer becomes aware of the condition. The employer also knows that the employee's condition is probably job-related because the job requires lifting, packaging, and standing for significant amounts of time and therefore likely developed or occurred while working.

Perhaps, more often than obvious injuries and perhaps more total expense in aggregate are the 'conditions' such as carpal tunnel, trigger finger, herniated disc, asthma, COPD, loss of hearing, etc. These might be work-related; it depends upon the type of work employees do and non-work lifestyles they live. So why deny them at greater expense as an employer and less benefit as employee? It's a different way of thinking.

What should the employer suggest:

(a) Encourage the employee to officially report this as a job-related condition and, therefore, generating a Workers' Compensation insurance claim ... or

(b) Encourage the employee to get care solely through his/her employer-sponsored group health insurance plan?

Unless an injury obviously occurs on the job, there is a choice here ... a dilemma. The direction could go either way. A likely job-related injury or disease can qualify for Workers' Compensation, so the choice is not clear.

If the employee goes through the group health insurance plan with extensive treatments from surgery to physical therapy, then the company's health insurance premiums likely will rise, especially if other employees and their families have been getting ill or having injuries.

If the employee goes through the Workers' Compensation insurance then the premiums are less likely to rise but the workplace safety record ... and that sign so many companies post with pride that tells how many days without a reported workplace injury will have to be reset to "0".

My convenience sampling over the years, especially while Executive Director of the New Jersey Council on Safety & Health, shows that most employers prefer their employees go the group health plan path. They do not want to see their workplace safety record impacted. It might hurt morale and lead to issues with OSHA.

You see, most small group employer health plans are not experience rated but medium and large-sized employer groups often are experience rated. After the initial year or two, Workers' Compensation plans tend not to be experience rated and do tend to be industry rated and/or job rated they comprise. So the one injury likely will have no effect on the this employer's premiums.

In short, all employers are required to have Workers' Compensation insurance plans to cover every employee, including governments. Usually, Workers' Compensation benefits are more plentiful than group health plans but they more strictly oversee treatments, hence expenditures. Workers' Compensation plan benefits vary by state. In New Jersey, where I live, benefits include: (a) medical care; (b) wage replacement (to a point); and (c) permanent injury payment.

NOTE: Medicare eligible employees must reimburse Medicare from any settlement or judgement for related expenses paid. Click here to see a summary of the rules.

So, in New Jersey, and in our example, the employee with the back injury, under Workers' Compensation plan, would have 100% of his/her medical costs paid forever as long as they relate to this injury, receive weekly salary replacement checks up to a maximum, and a permanency payment.

Only the permanency is negotiable ... once the fact of work-related is accepted by employer or ruled by the judge in the special insurance industry paid for Workers' Compensation Court system.

New Jersey Workers' Compensation Law and its court system might be among of the best public-private cooperative entities.

The NJ Workers' Compensation system is funded by 2% of all Workers' Compensation insurance premiums so it costs the government nothing. Additionally, that 2% covers the NJ Second Injury Fund , a clever mechanism for covering treatment related to the original injury, fully and for life, so that subsequent employers are more willing to hire a previously injured employee without fear of the potential additional costs.

Compare that to the employee under the group health plan who just gets medical cost coverage and still pays whatever copays and deductible & coinsurance is in their particular plan. Compare the costs of an employer's Workers' Compensation insurance policy.

Financially, the Workers' Compensation route benefits both the employer and employee. So why do most employers prefer that their employees go the group health route? How much are "(Lots of) Days Without Reported Injury" signs worth?

By Steve Reichenstein

Perhaps, more often than obvious injuries and perhaps more total expense in aggregate are the 'conditions' such as carpal tunnel, trigger finger, herniated disc, asthma, COPD, loss of hearing, etc. These might be work-related; it depends upon the type of work employees do and non-work lifestyles they live. So why deny them at greater expense as an employer and less benefit as employee? It's a different way of thinking.

What should the employer suggest:

(a) Encourage the employee to officially report this as a job-related condition and, therefore, generating a Workers' Compensation insurance claim ... or

(b) Encourage the employee to get care solely through his/her employer-sponsored group health insurance plan?

Unless an injury obviously occurs on the job, there is a choice here ... a dilemma. The direction could go either way. A likely job-related injury or disease can qualify for Workers' Compensation, so the choice is not clear.

If the employee goes through the group health insurance plan with extensive treatments from surgery to physical therapy, then the company's health insurance premiums likely will rise, especially if other employees and their families have been getting ill or having injuries.

If the employee goes through the Workers' Compensation insurance then the premiums are less likely to rise but the workplace safety record ... and that sign so many companies post with pride that tells how many days without a reported workplace injury will have to be reset to "0".

My convenience sampling over the years, especially while Executive Director of the New Jersey Council on Safety & Health, shows that most employers prefer their employees go the group health plan path. They do not want to see their workplace safety record impacted. It might hurt morale and lead to issues with OSHA.

You see, most small group employer health plans are not experience rated but medium and large-sized employer groups often are experience rated. After the initial year or two, Workers' Compensation plans tend not to be experience rated and do tend to be industry rated and/or job rated they comprise. So the one injury likely will have no effect on the this employer's premiums.

In short, all employers are required to have Workers' Compensation insurance plans to cover every employee, including governments. Usually, Workers' Compensation benefits are more plentiful than group health plans but they more strictly oversee treatments, hence expenditures. Workers' Compensation plan benefits vary by state. In New Jersey, where I live, benefits include: (a) medical care; (b) wage replacement (to a point); and (c) permanent injury payment.

NOTE: Medicare eligible employees must reimburse Medicare from any settlement or judgement for related expenses paid. Click here to see a summary of the rules.

So, in New Jersey, and in our example, the employee with the back injury, under Workers' Compensation plan, would have 100% of his/her medical costs paid forever as long as they relate to this injury, receive weekly salary replacement checks up to a maximum, and a permanency payment.

Only the permanency is negotiable ... once the fact of work-related is accepted by employer or ruled by the judge in the special insurance industry paid for Workers' Compensation Court system.

New Jersey Workers' Compensation Law and its court system might be among of the best public-private cooperative entities.

The NJ Workers' Compensation system is funded by 2% of all Workers' Compensation insurance premiums so it costs the government nothing. Additionally, that 2% covers the NJ Second Injury Fund , a clever mechanism for covering treatment related to the original injury, fully and for life, so that subsequent employers are more willing to hire a previously injured employee without fear of the potential additional costs.

Compare that to the employee under the group health plan who just gets medical cost coverage and still pays whatever copays and deductible & coinsurance is in their particular plan. Compare the costs of an employer's Workers' Compensation insurance policy.

Financially, the Workers' Compensation route benefits both the employer and employee. So why do most employers prefer that their employees go the group health route? How much are "(Lots of) Days Without Reported Injury" signs worth?

By Steve Reichenstein

Labels:

Council on Safety and Health,

New Jersey,

NJ,

Second Injury Fund,

Workers' Compensation,

Workman's Compensation

Friday, December 28, 2012

Malpractice Insurance, Medicaid Savings, and Physicians for the Poor

What I consider to be the most promising idea was a proposal brought to the Board of the NJ Taxpayers' Association in 2012 by Dr. Alieta Eck, co-founder of the Zarephath Health Center in Somerset, NJ. Dr. Eck proposes that the State of New Jersey to offer physicians free medical malpractice insurance in return for volunteering to care for the poor in a deal that would significantly lower the State's annual Medicaid spending tab.

To give this proposal added weight, and credibility, look back as recently to the early 1960's when all physicians were required to voluntarily treat the poor. Many, if not most, hospitals demainde a certain number of hours of "clinic" care in return to hospital practicing privileges. I remember this as a child ... and I'm not that old. So a deal for free medical malpractice insurance in return for volunteering to treat the poor -- either in-office or at free clinics like the Zarephath Health Center.

When I looked further into her numbers and then some more facts, such as those listed below, I began to see substantial savings in physician, hospital, and diagnostics payments. Much of these savings will be derived from the benefits of more use of primary care physicians for primary care and prevention rather than the emergency rooms for primary care and hospital stays & drugs for late-stage disease & chronic care.

Dr. Alieta Eck has testified before the U.S. Senate Subcommittee on Health, Education, Labor, and Pensions as well as being interviewed and writing op-eds in various publications. Doctors Alieta and John Eck has a private practice in Piscataway, NJ and serves as president of the New Jersey Chapter of the Association of American Physicians and Surgeons.

According to the our Doctors Alieta & John Eck's Zarephath Health Center proposal, New Jersey physicians pay a total of about $300 million annually in medical malpractice insurance premiums.

If all NJ physicians opt in, then NJ State would self-insure (with stop-gap) the equivalent of the $300 million annually for medical malpractice. If 10% of NJ physicians opted for the deal, then the State of NJ would self-insure the equivalent of $30 million annually. Of course the actual out-of-pocket costs to the State, likely will be much less.

On the other side of the equation, the according to the Kaiser Family Foundation (as in Kaiser Permanente founders) the State of New Jersey's expenditure on Medicaid and will see substantial savings under this proposal's idea.

According to the Kaiser Family Foundation's "StateHealthFacts.org":

-- The State of New Jersey pays 48% of residents' Medicaid spending as of 2009.

-- The state of New Jersey spent $10+ billion annually on Medicaid in 2010,

That's right. The State of New Jersey's 48% share of the statewide Mediaid tab runs about $10+ billion annually. A mere 1% savings on that would be $100 million!

More specifically, of that $10+ billion annually spent by the State on Medicaid,, the $6+ billion spent on physicians, hospitals, diagnostics, and drugs (acute care), likely would see some savings immediately and substantial savings over the next 10+ years as the greater use of primary care physicians both reduces emergency room visits and hospital stays. The portion of that paid directly to physicians, an estimated $50 million annually, would be slashed immediately.

This looks like a good deal to me: More available physicians, greater use of primary care physicians, lower State of NJ outlay for Medicaid, and lower medical malpractice premiums for participating physicians.

Are you willing to learn more about this Medicaid-Malpractice solution proposal? Would you sign a petition, write letters-to-the editor & articles, share Dr. Eck's post on Facebook & Twitter, and contact your state & federal legislators?

By Steve Reichenstein

To give this proposal added weight, and credibility, look back as recently to the early 1960's when all physicians were required to voluntarily treat the poor. Many, if not most, hospitals demainde a certain number of hours of "clinic" care in return to hospital practicing privileges. I remember this as a child ... and I'm not that old. So a deal for free medical malpractice insurance in return for volunteering to treat the poor -- either in-office or at free clinics like the Zarephath Health Center.

When I looked further into her numbers and then some more facts, such as those listed below, I began to see substantial savings in physician, hospital, and diagnostics payments. Much of these savings will be derived from the benefits of more use of primary care physicians for primary care and prevention rather than the emergency rooms for primary care and hospital stays & drugs for late-stage disease & chronic care.

Dr. Alieta Eck has testified before the U.S. Senate Subcommittee on Health, Education, Labor, and Pensions as well as being interviewed and writing op-eds in various publications. Doctors Alieta and John Eck has a private practice in Piscataway, NJ and serves as president of the New Jersey Chapter of the Association of American Physicians and Surgeons.

According to the our Doctors Alieta & John Eck's Zarephath Health Center proposal, New Jersey physicians pay a total of about $300 million annually in medical malpractice insurance premiums.

If all NJ physicians opt in, then NJ State would self-insure (with stop-gap) the equivalent of the $300 million annually for medical malpractice. If 10% of NJ physicians opted for the deal, then the State of NJ would self-insure the equivalent of $30 million annually. Of course the actual out-of-pocket costs to the State, likely will be much less.

On the other side of the equation, the according to the Kaiser Family Foundation (as in Kaiser Permanente founders) the State of New Jersey's expenditure on Medicaid and will see substantial savings under this proposal's idea.

According to the Kaiser Family Foundation's "StateHealthFacts.org":

-- The State of New Jersey pays 48% of residents' Medicaid spending as of 2009.

-- The state of New Jersey spent $10+ billion annually on Medicaid in 2010,

That's right. The State of New Jersey's 48% share of the statewide Mediaid tab runs about $10+ billion annually. A mere 1% savings on that would be $100 million!

More specifically, of that $10+ billion annually spent by the State on Medicaid,, the $6+ billion spent on physicians, hospitals, diagnostics, and drugs (acute care), likely would see some savings immediately and substantial savings over the next 10+ years as the greater use of primary care physicians both reduces emergency room visits and hospital stays. The portion of that paid directly to physicians, an estimated $50 million annually, would be slashed immediately.

This looks like a good deal to me: More available physicians, greater use of primary care physicians, lower State of NJ outlay for Medicaid, and lower medical malpractice premiums for participating physicians.

Are you willing to learn more about this Medicaid-Malpractice solution proposal? Would you sign a petition, write letters-to-the editor & articles, share Dr. Eck's post on Facebook & Twitter, and contact your state & federal legislators?

By Steve Reichenstein

Labels:

Alieta Eck,

Kaiser Family Foundation,

Medical Malpractice Insurance,

NJ Medicaid,

NJ Physicians,

NJ Taxpayers' Association

Sunday, April 29, 2012

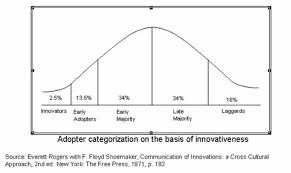

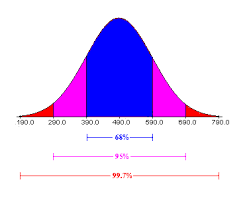

What's average?

So many reports and articles citing trends just say "average". Yet there are three ways to calculate average and they provide different information, so they have different meanings.

I wish writers and speakers would offer all three of them: Mean, Median, and Mode.

Most seem to like the 'mean' average and many like the 'median average. Yet few, if any, like to include the 'mode average' which I consider to be as, if not more, important than the others.

Mean average is calculated by totaling all of the quantities in all of the population groups and dividing by how many people are in all of the population groups.

Median average simple tells which group's quantity is in the middle, meaning half of the remaining people earn more than that and half of the remaining people earn less than that.

Mode average simply tells you which group's quantity has the most people in that group.

I want to know which quantity has the most of the people. That seems most relevant to me. Of course, I learn even more by knowing all three measures of average.

For example, if 5 people each earn $10,000; 1 person earns $60,000; 3 people each earn $100,000; and 2 people each earn $200,000, then:

-- Mean average earnings for this group of 10 people equals $73,636

-- Median average earnings for this group of 10 people equals $60,000

-- Mode average earnings for this group of 10 people is $10,000

In the above example, each measure of average paints a different picture. The mode average paints the most different picture. Together they say that some of the people earn a lot more than most of the people, but not so many people earn a lot more.

On a graph, the above would present a curve that has a peak towards the very low income level and then a low, somewhat flat tail towards the high income levels.

On a graph, a population with an ideally balanced curve is where the most people earn the incomes in the middle. We call that the bell-shaped curve. (Remember that from school?) If we are measuring income, then wouldn't we consider a healthy, wealthy, and happy population to be those with either a bell-shaped curve or a curve with the peak ... the mode ... above the middle?

Seeing that there are different ways to calculate average, that each gives you different information and impression about any population's income distribution and that calculating all of them gives you the fullest picture of the populations.

Now wouldn't you too want to see the full picture?

So wouldn't you too want to be told all three measures of average by the writer, speaker, economist, politician, and reporter?

Now you know why I told you that I want them to tell me all of the three measures of average?

Numbers only lie when you're not given all of the numbers. But that gets into the differences between "lies of commission" and "lies of omission". You know, when you tell someone something that you know isn't true versus when you don't tell them anything or everything. But that's an issue for another posting.

Hey, the next time people tells you that you ... or your kid ... is average, ask them what's "average"?

See you next post.

Steve Reichenstein

I wish writers and speakers would offer all three of them: Mean, Median, and Mode.

Most seem to like the 'mean' average and many like the 'median average. Yet few, if any, like to include the 'mode average' which I consider to be as, if not more, important than the others.

Mean average is calculated by totaling all of the quantities in all of the population groups and dividing by how many people are in all of the population groups.

Median average simple tells which group's quantity is in the middle, meaning half of the remaining people earn more than that and half of the remaining people earn less than that.

Mode average simply tells you which group's quantity has the most people in that group.

I want to know which quantity has the most of the people. That seems most relevant to me. Of course, I learn even more by knowing all three measures of average.

For example, if 5 people each earn $10,000; 1 person earns $60,000; 3 people each earn $100,000; and 2 people each earn $200,000, then:

-- Mean average earnings for this group of 10 people equals $73,636

-- Median average earnings for this group of 10 people equals $60,000

-- Mode average earnings for this group of 10 people is $10,000

In the above example, each measure of average paints a different picture. The mode average paints the most different picture. Together they say that some of the people earn a lot more than most of the people, but not so many people earn a lot more.

On a graph, the above would present a curve that has a peak towards the very low income level and then a low, somewhat flat tail towards the high income levels.

On a graph, a population with an ideally balanced curve is where the most people earn the incomes in the middle. We call that the bell-shaped curve. (Remember that from school?) If we are measuring income, then wouldn't we consider a healthy, wealthy, and happy population to be those with either a bell-shaped curve or a curve with the peak ... the mode ... above the middle?

Seeing that there are different ways to calculate average, that each gives you different information and impression about any population's income distribution and that calculating all of them gives you the fullest picture of the populations.

Now wouldn't you too want to see the full picture?

So wouldn't you too want to be told all three measures of average by the writer, speaker, economist, politician, and reporter?

Now you know why I told you that I want them to tell me all of the three measures of average?

Numbers only lie when you're not given all of the numbers. But that gets into the differences between "lies of commission" and "lies of omission". You know, when you tell someone something that you know isn't true versus when you don't tell them anything or everything. But that's an issue for another posting.

Hey, the next time people tells you that you ... or your kid ... is average, ask them what's "average"?

See you next post.

Steve Reichenstein

Subscribe to:

Posts (Atom)